NFL Weekly Betting Numbers: Monday Night Football Breakdown

Blog

NFL Weekly Betting Numbers: Monday Night Football Breakdown

Dive into the NFL action with our in-depth analysis of Same Game Parlay (SGP) bets placed during the highly anticipated Monday Night Football showdown between the Chargers and Bengals. From the most popular markets to the balance between player props, core, and derivative markets, we’ll unpack the trends shaping bettor behavior. Discover what’s fueling the excitement around SGPs, and how players are engaging with this dynamic betting experience.

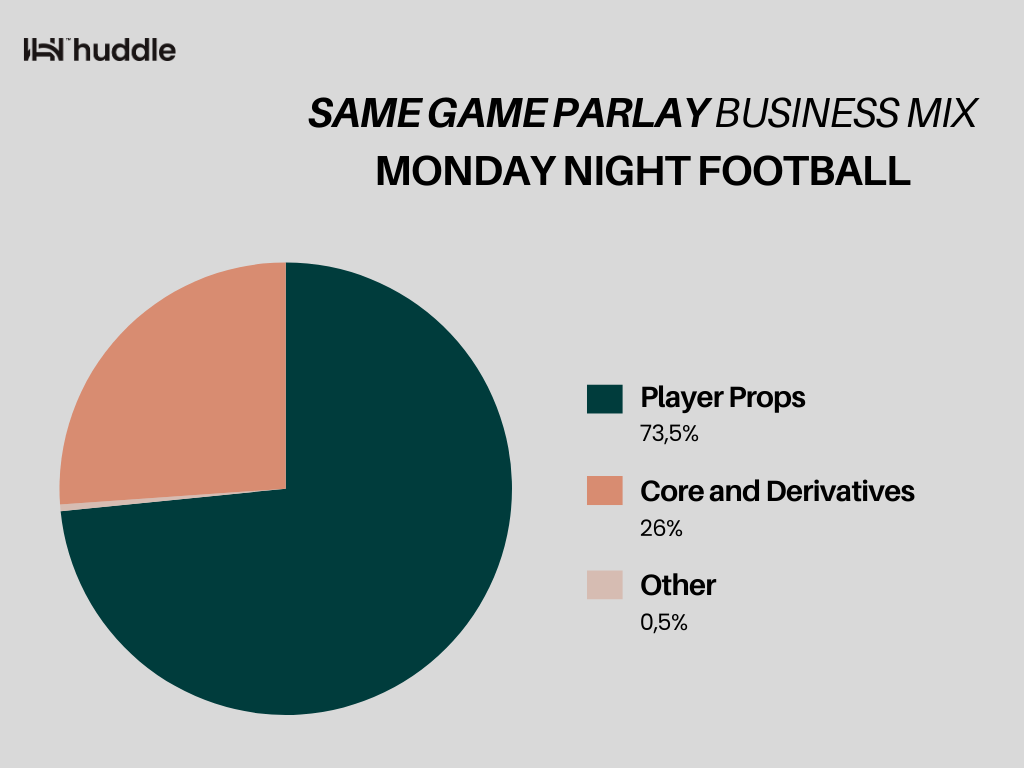

Same Game Parlay Business Mix

Player Props account for a substantial 73% of the business mix, highlighting a strong preference among NFL bettors for player-focused wagers. This trend reflects a growing interest in individual player performances over traditional team outcomes.

With the NFL boasting a roster of genuine superstars, sportsbooks are increasingly adapting their offerings to feature player-centric markets. Prioritizing player props aligns with the shift towards a fanbase that values individual performance and instant engagement. This shift emphasizes the importance of real-time market creation, dynamic pricing, and quick settlement—areas where Huddle excels.

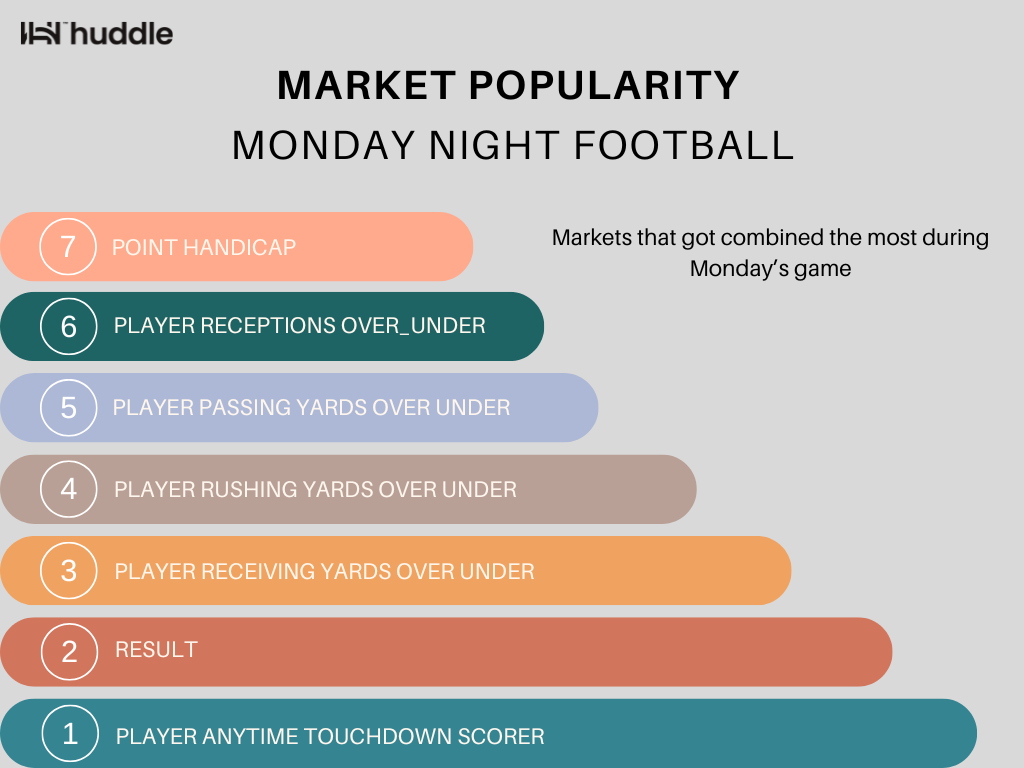

Market Popularity in SGP

This graph highlights the dominance of player markets in betting during Monday Night Football, with five out of the seven most popular markets being player-specific. Player props such as "Anytime Touchdown Scorer," "Receiving Yards Over/Under," and "Rushing Yards Over/Under" significantly outpaced traditional markets like "Point Handicap" and "Result." This trend underscores the growing bettor preference for individual performance over team outcomes.

The shift reflects a broader industry trend toward enhanced fan engagement, where sportsbooks cater to bettors seeking a deeper connection with players and instant gratification through dynamic, player-focused markets.

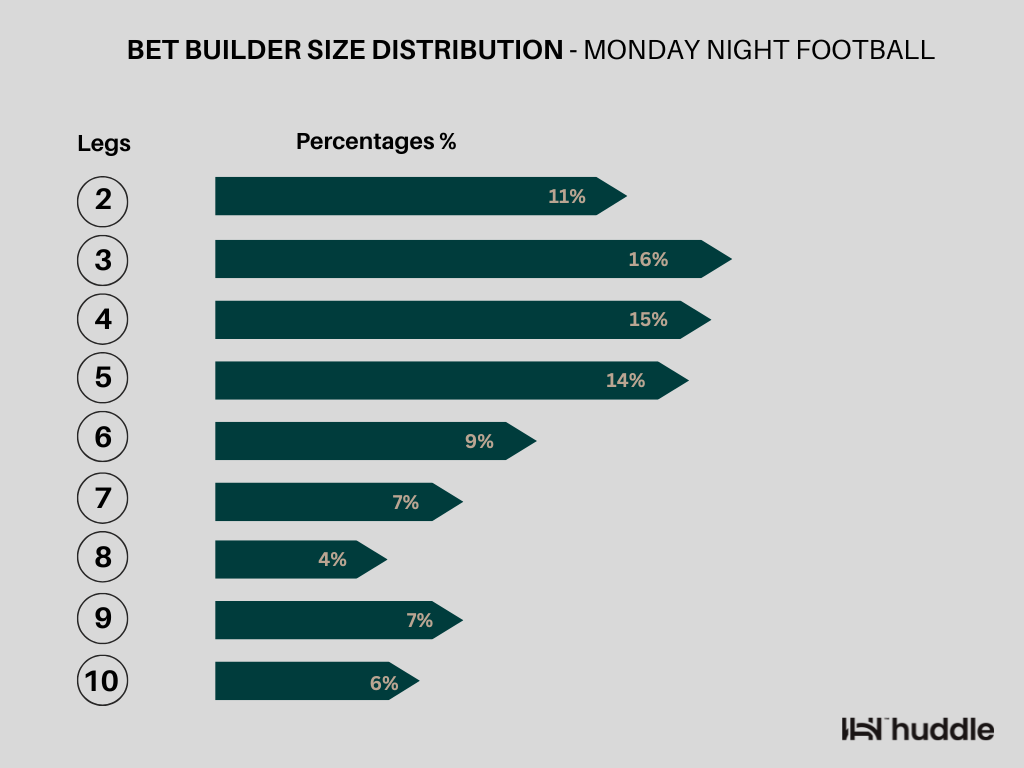

Bet Builder Size

This graph highlights how bettors approach bet builders during Monday Night Football. Most players favor moderate-sized parlays with 3-5 legs, balancing risk and reward, while larger combinations with more legs are less popular due to their higher complexity and lower chances of winning. The preference for smaller, more manageable bets shows that bettors value a strategic approach, aiming for a mix of excitement and realistic payouts.

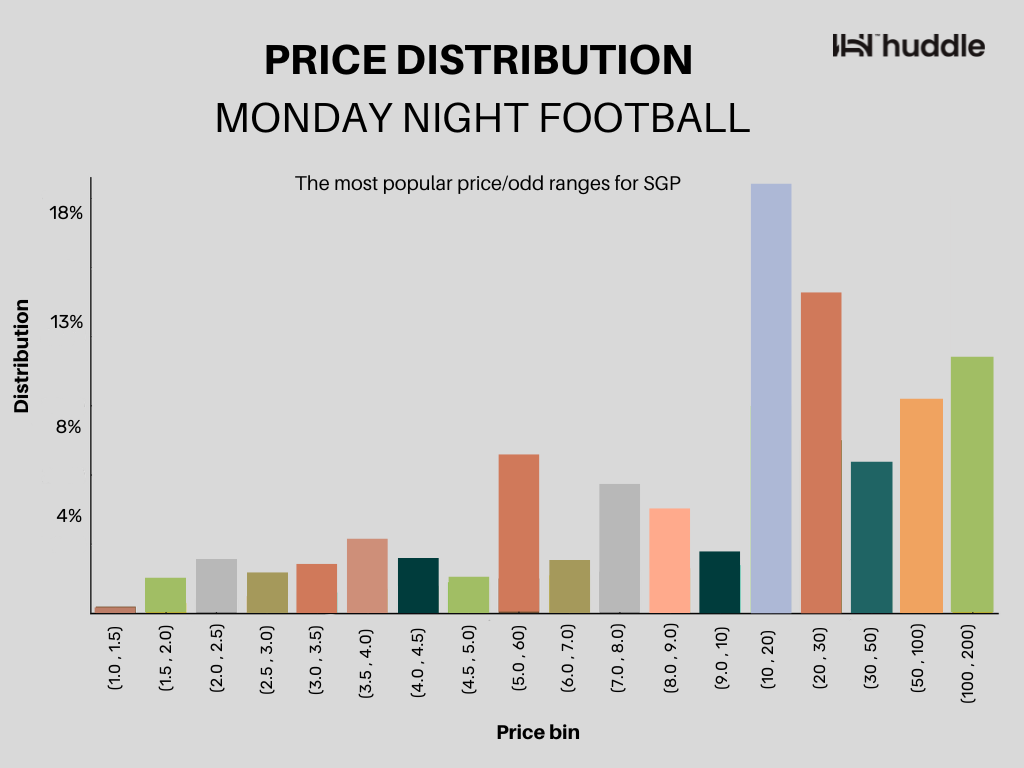

Price Distribution

This distribution reveals a clear preference among bettors for odds that strike a balance between achievable wins and exciting, high-value payouts. The most popular range, 10.0–20.0, reflects a sweet spot where bettors feel confident enough in their selections to aim for substantial returns without venturing into overly risky territory.

The significant interest in higher odds ranges, such as 20.0–30.0 and even 100.0–200.0, shows that many bettors are willing to take calculated risks in pursuit of larger payouts, likely driven by the thrill and entertainment value of betting. On the other hand, the minimal activity in lower odds ranges suggests that bettors are less interested in low-risk, low-reward bets.

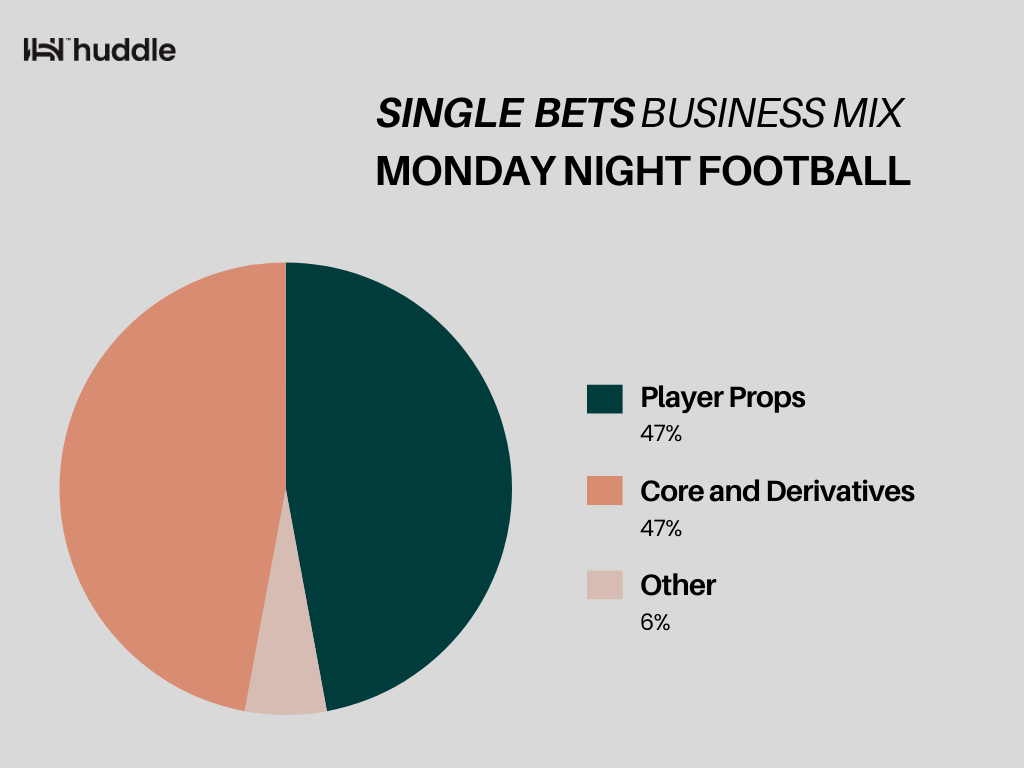

Single Bets Business Mix

This graph focuses on the distribution of individual bets. It shows an equal split between Player Props (47%) and Core and Derivative markets (47%), with a smaller portion (6%) for other markets. This indicates that single bets are evenly divided between player-focused and team-focused wagering, with a slight exploration of niche markets.

In single bets, Player Props share the spotlight equally with Core and Derivative markets. In SGPs, Player Props dominate, showing bettors' preference for combining individual player performance bets when building parlays.

Check out the latest interview with Leo Gaspar on 3 Key Factors Driving the Adoption of Player Props in the US. Click HERE!